Pricing isn’t easy, but it doesn’t have to be complicated. Don’t scare away potential customers by charging too much, but if you charge too little and leave money on the table, you’ll have fewer resources to put toward improving your application. How do you decide how much to charge? There are a few schools of thought and a handful of factors to consider.

Charge Money

Revenue is how businesses stay alive. So charge money. Many people will tolerate a subpar product if they don’t have to pay for it. But once people have to start paying, their standards rise dramatically. From what I’ve seen around the web, products with a free plan generally see 1–3% of customers choosing a paid plan. Charging money helps you discover if people truly value your product.

I had originally planned to open-source Sifter. When Keith first suggested I create a business out of it, I unequivocally dismissed the idea–I thought making it a business would be a lot more work with a lot more risk. In hindsight, I can say that if I hadn’t created a business out of it, Sifter would undoubtedly have been a shadow of what it became–it probably wouldn’t even exist. Charging money isn’t about being greedy; it allows you to spend time on your idea. As Walt Disney once said, “We don’t make movies to make money; we make money to make more movies.”

Recurring Revenue is Amazing

When you think about pricing, one of the simplest questions is choosing between recurring charges or one-time charges. With most SaaS, I hope everyone is leaning towards lower recurring charges and not higher one-time charges. If you’re not, let me try to convince you.

Recurring revenue through subscriptions brings stability to your business. You don’t have to worry as much about managing cash flow because things are fairly reliable from one month (or year) to the next. This may seem small on the surface, but read a few business books and you’ll quickly begin to see a pattern about how much stress within a business is driven by volatile cash flows.

Also, with a lower up-front cost, you’re reducing the risk for people to try your product and thus increasing the chance that someone will buy it. Of course, that means it has to make them want to keep paying, but you can handle that part.

Finally, recurring revenue is an incredible form of disability insurance. With Sifter, there was a three-year period before my amputation where I really struggled to get work done. Between pain, doctor’s appointments, surgeries, hospital stays, physical therapy, and everything else, it was incredibly difficult to work. However, as long as I stayed on top of support and bug fixes, Sifter kept making money. In fact, it grew enough that I was able to give myself a raise. Recurring revenue is incredibly powerful. If you’re on the fence, I definitely recommend trying to create a subscription-based business model.

Be Wary of “Free” and “Unlimited”

The words “free” and “unlimited” should scare you. They sound nice on the surface, but they set unrealistic expectations. If you use these words, you need to be cautious–and you should ask yourself whether you might regret that decision in the future. For instance, touting unlimited file storage with your most expensive plan could lead to a difficult conversation with a customer who took that literally. I’m not saying never use these words–although that’s just about what I’m saying–but if you use them, stop for a moment to make sure you mean it.

Don’t Default to What Everybody Else Is Doing

There’s an incredible amount of “me too” pricing in SaaS these days. In some cases, it makes sense, but in others it feels like a product is being shoehorned into a pricing structure. There’s a place for using a similar pricing model, but don’t start with one without thinking it through.

Price is like any other feature of your product: don’t just choose the first solution that pops into your head. Spend some time thinking about it from your customers’ perspective. What’s a good billing model? What’s a fair price? Then think about your business model and what’s sustainable. Balance the two to find a price that really feels right. You probably won’t get it perfect, but you’ll be close enough that if you have to change your pricing later, customers won’t be completely caught off guard.

Cover Your Costs

With hosted web applications, there are quite a few nearly invisible costs that you need to factor in to your pricing. If you charge $29 a month, you’re not going to see $29 in your bank account. You’re going to see what’s left after you pay for your credit card fees, hosting, file storage, email, and other infrastructure costs. Selling software for a loss or low margin won’t scale.

Thankfully, with hosted software, your costs are usually cheap enough that most of your price points will make money. But if you’re thinking about offering any plans at less than $10 a month, your margins will likely be so thin that you’ll do little better than break even, once you factor in customer acquisition costs. That’s not to say you shouldn’t offer less expensive plans, but don’t expect a bevy of sub-$10 plans to get your bootstrapped business off the ground.

Pricing Structure

In conjunction with choosing how much to charge, think about how to charge; that is, do you charge for features, resources, value, seats–or something else entirely? How many plans should you offer? Do you want to charge monthly, annually, or offer both? Since we’re focusing on web applications, we’ll assume that you’ll charge a recurring fee; the following discussion relies on that assumption.

A product’s value is one of the best ways to determine its price. For instance, if your product were to save a business $50,000 a month, you’d be selling yourself short if you were to only charge $15 a month. I don’t mean charge $10,000 a month, but make sure your pricing stems from the value you provide.

Many companies base their pricing on seats or users. This can be a good approach if your product offers equivalent or consistent value for each user; it’s profitable and ensures that your revenue grows with your customers’ usage. But it can also implicitly become a participation tax; if your software is designed to help people collaborate, companies would have to pay more as they increase the number of participants.

Alternatively, you could base your pricing on a limited resource. For instance, Sifter’s pricing hinges on the number of projects an account has. When Sifter’s customers have more projects, that brings with it more profit and more team members–and they receive more value from Sifter. In addition to limiting projects, Sifter also limit file storage. As long as your pricing scales with your costs, you can be confident that you won’t be in a situation where you’re losing money.

In some cases, you can implicitly create seat-based pricing by limiting the number of user accounts or the types of user accounts. If you were to have a help desk, you could allow unlimited user accounts but only allow a certain number of support staff. The catch with these types of limits is that it can sometimes be a little frustrating for your customers when they add that one additional person to their team and find they’ve been bumped into your next pricing tier.

Another option to limit is features. You might allow only certain pricing levels to have file uploads or email integration, for example. This can help increase upgrades, but it can also be tricky to choose the right balance of features. By limiting access to a feature your customers perceive as core or baseline functionality, you might inadvertently turn away customers. No matter what you do, though, never charge for additional layers of security. Security is a business obligation. It’s not an add-on.

You also need to figure out how your plans or tiers are structured. Tiers are useful because they help cover your customer’s varying budgets. If you offered only one plan at $50 a month, but there were a handful of customers willing to pay $100 a month, you’d lose out on potential revenue. Similarly, if some customers could only afford $25 a month, they would never become customers. By offering tiers, you can maximize your revenue. Don’t get carried away, however–if you offer too many options, you might overwhelm potential customers and they might not buy anything at all.

Change Is OK (If You Grandfather Your Customers)

If you do all this and still make a mistake, don’t worry–changing your pricing isn’t the end of the world. It’s not ideal, but it can be done and plenty of businesses have done it. You shouldn’t adjust your prices too often, but don’t be afraid to admit you don’t know how much to charge. You can always change your pricing later. Changing the price is one thing–changing how you price is a different story.

I can’t stress this enough: if you change your prices, you should grandfather in your existing customers–unless doing so would put you out of business. If you don’t, you may find yourself facing a painful distraction. You’re better off honoring your customers’ current pricing than squeezing a few extra dollars out of them. More importantly, they deserve it. There are countless stories of companies botching their pricing changes and chasing away a significant portion of customers. In some cases, this may have been financially successful for the company, but the damage to their brand often lasts for years.

Starting out with higher prices may seem scary–you could put off potential customers–but remember it’s always easier to lower prices than to raise them. That said, don’t be afraid of raising prices if you need to.

Keep Pricing Simple

As you think through your pricing, creative ideas may pop into your head to help make your pricing more flexible or fairer. Typically, these ideas will drastically complicate things for both you and your customers. As your pricing becomes more complex, the burden on your customers to understand your pricing increases as well.

It also puts you on the hook for writing and maintaining the code that handles the pricing, and complex billing code is very problematic. Bugs create billing issues, which lead to unhappy customers and increased support costs. Or, you might simply end up spending more time explaining bills to customers and answering questions. None of this helps you focus on what really matters. Keep your pricing simple and fair, and then get back to work on your product.

Listen to Customers, but Be Wary about Pricing Feedback

If you sent out a survey asking your customers if they’d like the price to be lower, do you think anyone would say no? Probably not. Asking for discounts and a lower price is the easiest feedback in the world. Usually, these requests have less to do with your product and more to do with the buyer’s context.

It’s important to listen to customer feedback around pricing, but you may find their requests are driven by things like conversion rates or their own business not making any money. Do your best to dig down and understand the situation. If there’s something reasonable you can do, make it happen; if not, let them know and move on.

Non-Profit and Educational Discounts

Once you launch your business, it’s only a matter of time before someone requests an educational or non-profit discount. This may or may not be important to you, but it’s something worth thinking about ahead of time. Offering recurring discounts means writing and maintaining a little more code, or manually updating accounts and bills. Both of these can be a distraction. My advice is to not worry about a discount system from day one, but if supporting non-profits and students is important to you, set aside some time for it once the requests start coming in.

Anecdote: Removing the $14 Plan from Sifter

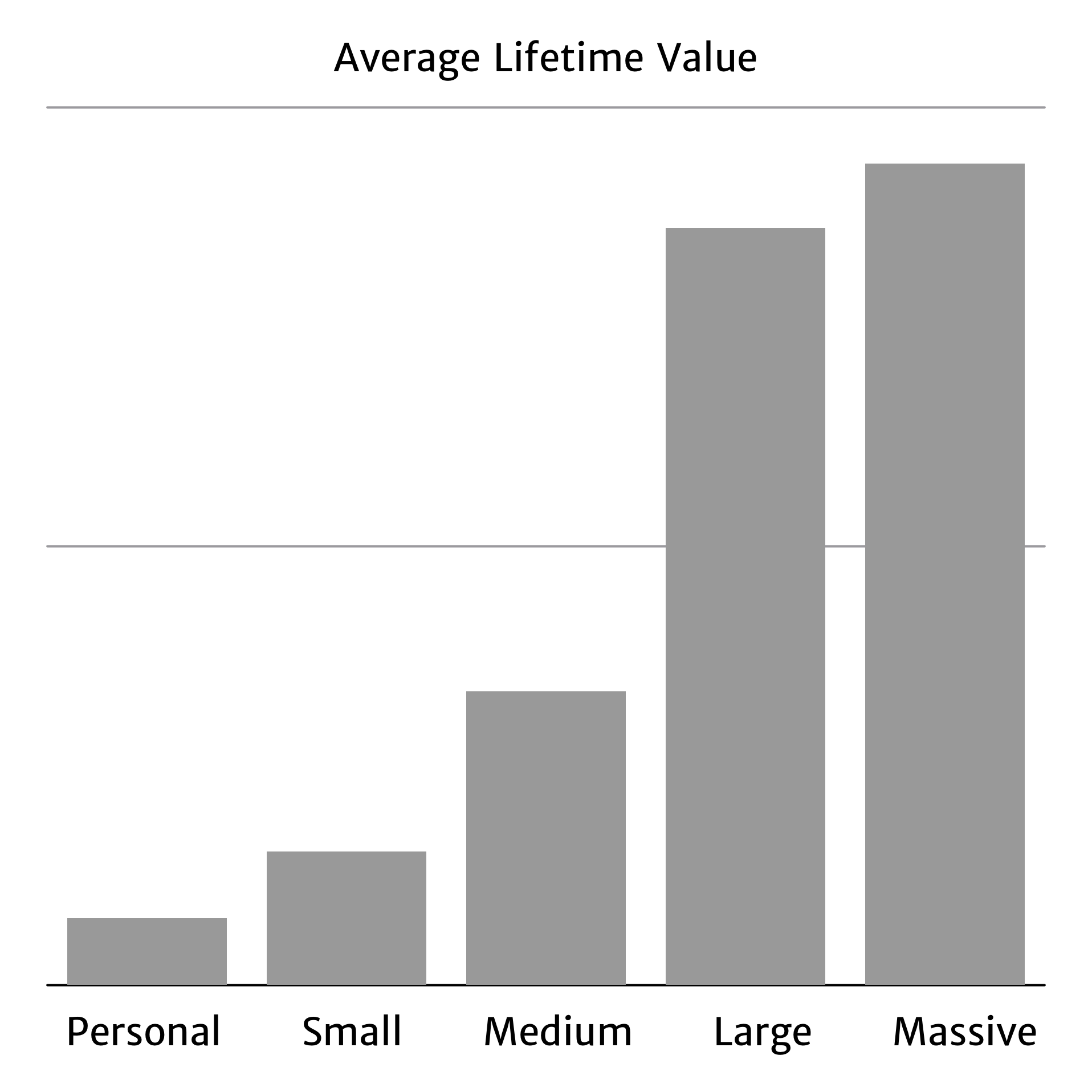

Some time after our launch, I realized our $14 plan wasn’t practical for the level of service I had wanted to provide. I can’t speak for other apps, but most communication with a customer usually happens in their first month. Be it feature requests or questions about how things work, it takes time to answer these emails. We saw the highest turnover with our $14 plan, and with its low price, the lifetime value of those customers was significantly lower. Moreover, the customer growth on our $14 plan had slowed significantly compared with our other plans. So we decided to focus on our more expensive plans. (Figure 1)

Given our customer churn and the plan’s lower price, the average lifetime value of our $14 plan was significantly lower than our other plans.

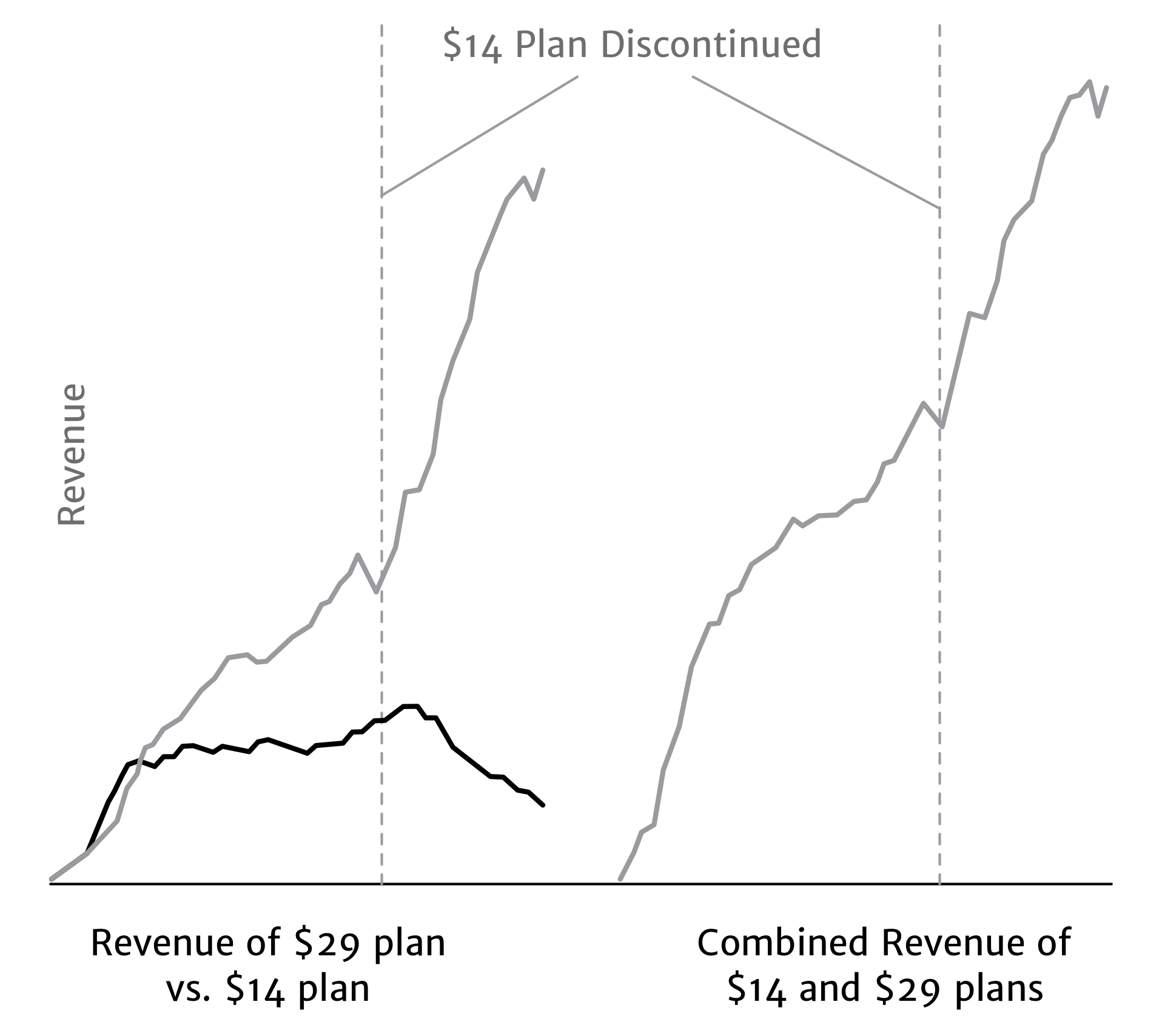

↩︎What effect did this have on our bottom line? Our visitor-to-trial conversion rate immediately dropped–that is, fewer people were signing up for free trials. But the number of customers signing up for our $29 plan skyrocketed. Our original theory was that this would be a break-even decision–half of the people who would have signed up for our $14 plan wouldn’t sign up at all, and the other half would sign up for the $29 plan. (That is, for each potential customer we would lose, we’d gain one who would bring in twice the revenue, covering the difference of the lost customer.) But by gaining so many more customers on the $29 plan, we actually came out ahead. (Figure 2)

Removing our $14 plan ended up being a boon to our overall revenue and didn’t hurt our growth in the slightest.

↩︎Related Reading

Doubling SaaS Revenue by Changing the Pricing Model Patrick McKenzie provides a great real-world example of how adjusting your pricing structure can have dramatic impacts on revenue. There are some gems in the comments too.