As you scale, churn will become a larger priority. Seemingly small numbers add up big when you look at the compounding nature of SaaS. Let’s do some quick math. If your monthly churn rate is 10%, you’ll have to completely replace your entire customer base every year just to break even.

This might seem like an extreme example, but it’s not so far-fetched. And even when you look at something more common, say a 5% monthly churn rate, it’s not a much brighter picture. If you have 100 customers in January you’ll need to bring on 46 new customers (almost half of what you started with) by December just to still have 100 customers at the end of the year.

Churn is a counter-force to your hard-fought acquisition efforts that can often eat away silently at growth. Numbers like 5% don’t look so big initially, but as you can see, a percentage point here or there, especially as you scale, makes a huge difference.

Furthermore, without regular new sources of growth your growth rate will inevitably shrink over time as your company grows ever larger. This is simple math, if you grow at 100 accounts per month, your growth is linear. Over time, 100 is a smaller and smaller percentage of your customer base. Your churn rate is the opposite. Churn is a constant percentage of your total accounts. For example, 5% churn with 100 accounts means losing 5 accounts. 5% churn with 1,000 accounts means losing 50 accounts. So churn eats away at your customer base faster the larger you grow. Not cool!

But I don’t like thinking about churn in terms of compounding losses. Too often, when we talk about churn, it’s framed as a negative, scary side of the business that’s not fun or exciting to focus on. But that couldn’t be more backwards. Addressing churn is where some of the most significant opportunities exist to grow and strengthen your company by extending lifetime value.

The numbers above might seem a bit daunting, but churn prevention isn’t meant to be fear-driven. Look for the opportunities in these numbers, rather than the potential losses.

The good news is, not only is it totally doable to get churn under control, you’ll likely find the process one of the most rewarding improvements you’ll make as a business owner. It’s a direct reflection of your ability to provide value to your customers and build long-term relationships. As you improve, you can shift your focus from limiting churn to hitting negative churn, which is where the real fun starts!

But for now, the earlier you can start reigning in your churn bit-by-bit, the better. Otherwise you’ll end up spinning your wheels on acquisition, putting yourself in a state of treading water.

It’s important to look at churn holistically. Of your total “churn pie”, you’ll need to look at the two sides of churn: involuntary and voluntary.

“Involuntary churn” is churn due to failed payments (See the Dunning 101 chapter for common reasons and stats.) This group of customers is made up of people who never get payment issues resolved. They disappear, even if they otherwise would have continued being a customer.

Over the past several years, we’ve regularly seen companies where 50% of their total churn for B2B can be attributed to failed payments. These numbers climb even higher for some B2C business models that can be more volatile or susceptible to credit card issues.

The fantastic news about involuntary churn is that it’s one of the easiest holes to plug in your business. Typically up to 70% or more of these failures are able to be recovered and customer lifetime values restored. But that number may vary depending on your unique business model.

Not only is this one of the quickest ways to slash your churn, but the effort it takes to fix this problem is easier than ever.

For starters, you’ll want to re-evaluate the basic dunning system you set up in the early days and look into outsourcing to a more advanced system to maximize recoveries. You’re likely letting a lot of customers slip through the cracks, and burdening your support team with higher volumes of customers to try and win back manually.

We’ve seen how every 1% improvement matters, and there’s zero reason anyone should lose a customer involuntarily. Depending on your payment processor you’ll have different options available to you to tackle this, but specialists have been building better and better systems to get closer to eliminating involuntary churn for good. Take advantage of what’s out there. If it’s effective, it will be one of the few things you can sign up for that actually makes your business money every month.

“Voluntary churn” is a tougher nut to crack, because it’s not as binary as dealing with failed payments. You’ll need to diagnose the root cause(s) of your churn.

Some common causes of churn:

- Confusing/ineffective onboarding

- Poor expectation setting

- Misleading sales pitches

- Not delivering on promises to/expectations of customers

- Glaring product flaw

- Poor customer service

- Outperformed by a competitor

- Don’t have solid product-market-fit

Chances are you’ll start to see a trend with at least one of these. Don’t panic and react to every criticism, but look for commonalities that you can address and affect the majority of the problem.

There are a few ways to start to diagnose what’s going on.

The best way is to talk to your customers. Unfortunately, once someone’s thinking about leaving, they’re probably already lost. So talking to your customers early and often is the best thing you’ll ever do. There are a lot of tools to survey your customers at-large, feel free to try any of them, but don’t let that excuse you from actually talking one-on-one with people. Lots of them.

When you really, truly have a finger on the pulse of your customer base, none of these potential churn causes will seem like much of a mystery anymore. You’ll hear common critiques, questions, concerns, and areas of excitement. Most of the guesswork will be resolved and you can put your focus on addressing the issues and strengthening the features of your product that your customers love the most.

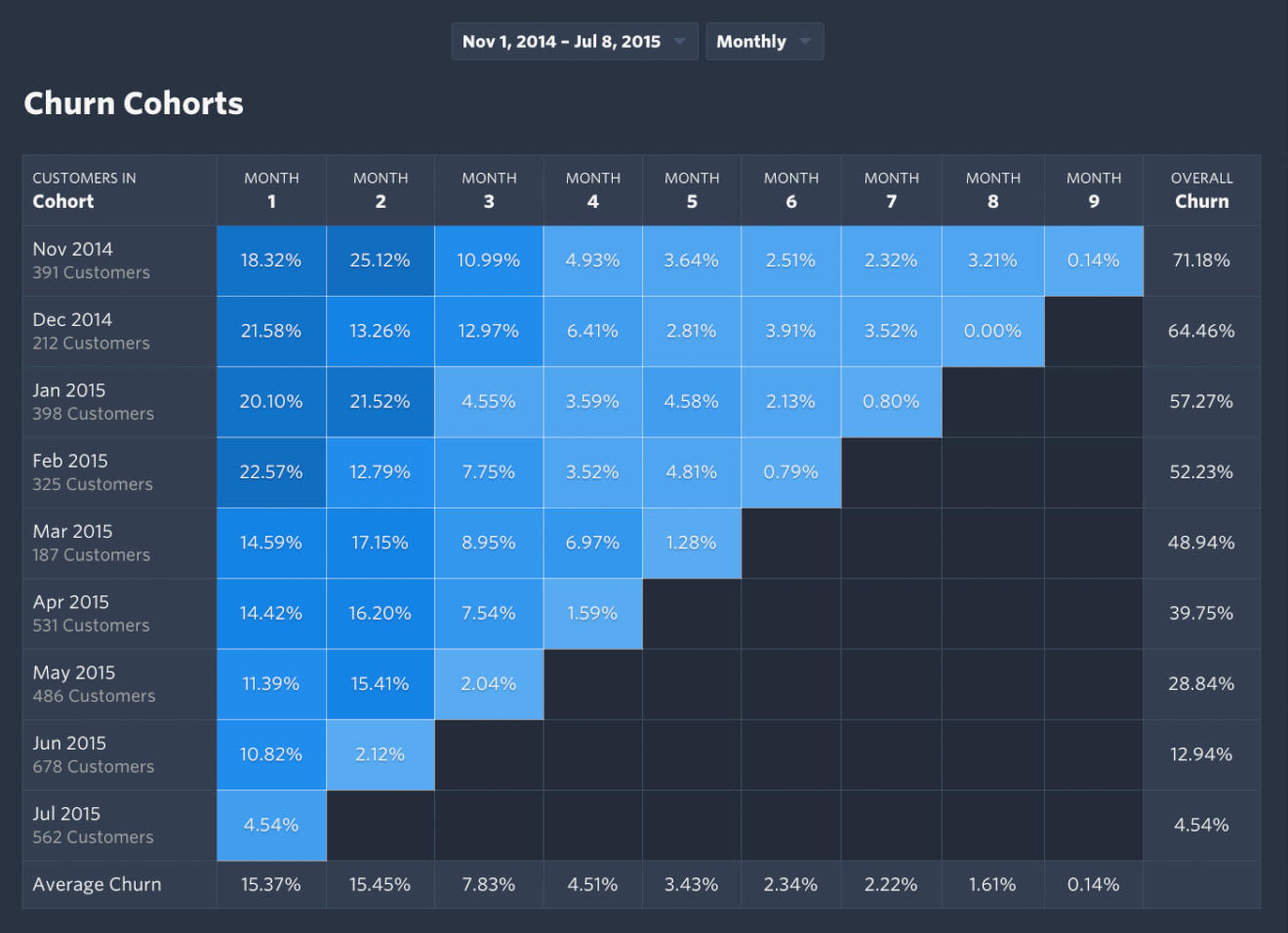

Another great way to spot trends and potential pitfalls that lead to churn is looking at a cohort table. Cohort analysis brings insight into pieces of your data that don’t show up when you’re simply looking at totals and averages. This is because it displays a clear relationship between a particular group of people and their behavior.

Take the table below as an example.

Cohort tables can help you notice long-term trends based on looking at the retention of specific groups of new customers over time.

↩︎- Each row represents a group of customers who activated in the same month.

- Each cell as you go across the row represents the number of months since each person signed up.

- Within each cell, you’ll see the churn rate for that group of customers, during that time period.

- On the right, you’ll see the total # of customers in each row that have churned (so far).

- On the bottom, you’ll see the average churn during each week or month after signup.

So what can a churn cohort table tell you? Say you participated in a package deal with a bunch of other apps in January, and by April, you notice that very few of them are still with you. Bundles or steep discounts may have gotten signups through the door, but not ones that are likely to be good fit/long-term customers.

Some companies find that users sign up for their product for a particular, short-term or project-based use, and once the project is complete, churn spikes. Trends might also show a common point in the customer lifecycle where people switch to a more sophisticated product after, say 6 months of using yours. If churn is really high in month one, it might be an indicator of a misleading ad campaign driving unqualified traffic. Or perhaps a poor onboarding process.

A cohort table can’t single-handedly diagnose churn, but it’s an incredibly effective way to start to see trends and signals so you can dig deeper into what’s going on.

Lastly, set up automatic exit questions. You’re going to have some people leave, no matter what. Don’t let them silently disappear without at least asking them why they’re leaving. Not everyone will give you a response or even a truthful reason, but many will. And this feedback might prove to be some of the most valuable insight you get. This doesn’t mean making it hard for people to cancel. Just ask what you could have done better.

Churn is a difficult beast to tame. But when approached with deliberate and thoughtful effort, it can be turned into a force for good. At Churn Buster, we spent much of 2016 pumping the brakes, and slowing down to fix the problems that customers were encountering. We called it “getting to neutral.”

Slowing down didn’t just help us unlock consistent negative churn through fewer cancellations, more regular upgrades, and increased pricing. It has enabled us to speed up on just about every other aspect of growth and product development because we aren’t fighting such a strong counter-force.

Pay attention to your SaaS fundamentals and growth will come much easier with far less accompanying stress.